A recent article in the New York Times (click HERE for full story) tells the story of a family who got help from an Elder Mediator with a distressing family situation.

An elderly client was calling her caregiver in the middle of the night and making unreasonable demands. The caregiver was close to quitting her job. At a family meeting facilitated by attorney and elder mediator Joy Rosenthal, the family discussed the issues and needs of various people affected, including the elderly person and the caregiver. Then, the group came up with a list of things they could to to make the situation more manageable for everyone.

There are a couple of things I love about this story.

For one thing, it makes it clear that Elder Mediation is helpful in many cases that would not call for court action. The issue of calling a caregiver in the middle of the night was not the type of thing that people go to court for. Yes, it is true: mediation is appropriate for situations involving very serious issues that could legitimately be taken to court. But mediation is not limited to these types of situations. It can be helpful at every level of conflict. Indeed, the earlier a family calls in a mediator, the better.

When the family calls a mediator at the first sign of distress, the mediator can intervene before the family has become polarized and estranged from one another. (In cases where family appears headed for court, early intervention by a mediator may save not only relationships but tens of thousands of dollars in legal fees and court costs.) Additonally, mediation enables families to consider options that would never be available in a court of law. In this case, the family was able to intervene before the caregiver quit, and mediation enabled them to work together to forge a creative, win-win solution. The result? The elderly client was happier, everyone had a better understanding of each other, the caregiver was able to to keep her job and work more reasonable hours, and the elderly client was able to retain a trusted employee. Even more important, the air was cleared, people understood each other better, and a better foundation was laid for future decision making.

Another thing I like about the story is the simplicity of the solution and the way the solution met the true needs of all the parties. (To learn the exact problem and solution, read the story!) As this story illustrates, sometimes the solution is very simple, and all it takes is to talk it through.

As simple as the solution sounds, however, I’m certain it was worthwhile to engage the mediator. A qualified elder mediator isn't just a person who has decided to act as a middle man and "keep the peace". A mediator, if properly qualified as an Elder Mediator, is a seasoned professional with advanced training not only in basic mediation skills, but also in mediation of large and complex family issues, and they will have specific training or expertise in elder and geriatric issues. The mediator will know how to set the stage and manage a meeting in such a way as to ensure that all family members are heard and all interests are on the table before options or solutions are considered to address those needs. The integrity of the mediation process is what ensures that once a solution is in place, it is a good solution that does meet all needs, and not just a knee-jerk, slap-a-bandage reaction. Indeed, that is one of the best values that mediation offers. By going through the steps in a methodical way, as led by a expert in conflict management, families who choose mediation actually address root causes. Conflict addressed in this way offers opportunity for families to develop better systems of communicating and making decisions, and thereby have the opportunity to achieve authentic healing and reconciliation. It's virtually a no-lose proposition.

To find a mediator in your area, search through mediators listed on the web site Mediate.com, or search specifically for an elder mediator on the site ElderCareMediators.com . I've also written a guide to choosing an elder mediator, which can be accessed HERE.

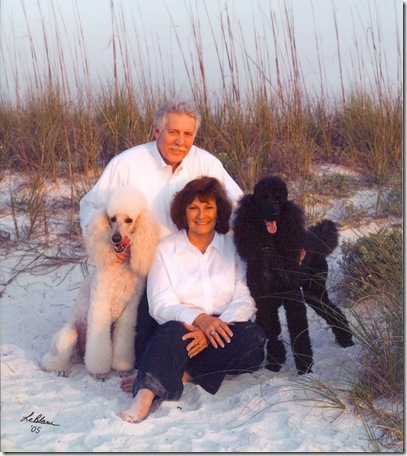

[caption id="attachment_475" align="alignright" width="300" caption="The author with her grandmother"] [/caption]

[/caption]

(My own background that prepares me as an Elder Mediator includes approximately 160 hours of study of mediation techniques (including specific study with Zena Zumeta and Susan Butterwick in mediation of Elder issues and contested guardianship cases and study with Richard Blackburn in conflict transformation in large group settings), personal study in elder law, personal experience in elder care management, and graduate level study in medical ethics. I am a member of the Elder Decisions section of the Association of Conflict Resolution, and I am listed on both of the above sites in the field of Elder Mediation.)